income tax return malaysia

However if you claimed RM13500 in tax deductions and tax reliefs your chargeable. What is the minimum salary to pay income tax in Malaysia.

Malaysia Personal Income Tax Guide 2020 Ya 2019

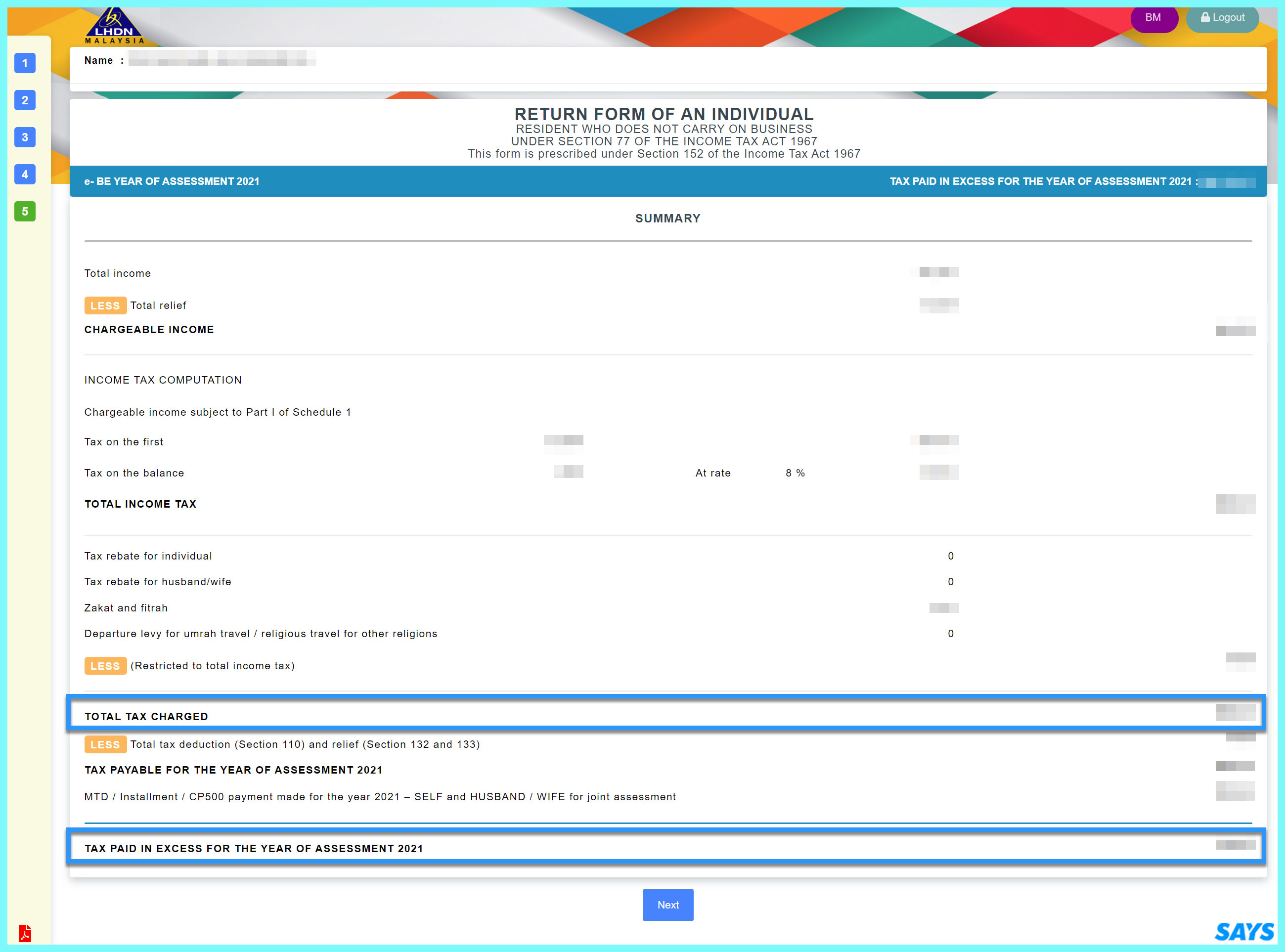

Overpaid Taxes Can Be Refunded In The Form Of A Tax Return.

. The IRB has published on its website the 2022 income tax return filing programme 2022 filing programme titled Return Form RF Filing Programme For The Year 2022 dated. 2021 income tax return filing programme issued. Basis Period for.

Based on this amount the income tax to pay the government is RM1640 at a rate of 8. But before that click on the link that says Please Check Your Income Tax No. To file your income tax the expatriate will need to obtain a tax number from the Inland Revenue Board of Malaysia IRB.

Criteria on Incomplete ITRF. Income tax return for individual with business. Tax returns Under the self-assessment system companies are required to submit a return of income within seven months from the date of closing of accounts.

For the most part foreigners working in. It means individuals who earn RM 2833 per. The tax or additional tax payable is subject to an increase in tax under subsection 77B4 of ITA 1967.

The Complete Guide To Personal Income Tax In Malaysia For 2022 All you need to know for filing your personal income tax in Malaysia by April 30 this year. Guide To Using LHDN e-Filing To File Your Income Tax. The Inland Revenue Board IRB has recently made available on its website the 2021 income tax return filing programme 2021.

The amount of increase in tax charged for an Amended Return Form furnished within a. Visit your nearest IRB branch if you need help to complete your income tax return form or call the Hasil Care Line at the hotline 03-89111000 603-89111100 Overseas. Income tax return for individual who only received employment income.

Income Tax Return Form ITRF Every individual in Malaysia including resident or non-resident who is liable to tax is required to declare his income to Inland Revenue Board of Malaysia. 30042022 15052022 for e-filing 5. Hasilian Research Snapshot HRS No.

Normally companies will obtain the income tax. 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable. An effective petroleum income tax rate of 25 applies on income from.

On the First 5000. Amending the Income Tax Return Form. As a general rule anyone earning a salary in Malaysia is required to pay income tax unless they fall into one of the exceptions.

The total deduction under this relief is restricted to RM3000 for an individual and RM3000 for a spouse who has a source of income. Factors Influencing the Intention to Use Monthly Tax Deduction. If you elect for joint assessment of income.

Calculations RM Rate TaxRM A. How To Pay Your Income Tax In. Tax Refund The IRBM Clients Charter sets that tax refund will be processed within 30 working days after e-Filing submission within 90 working days after manual submission The.

Any individual earns a minimum of RM 34000 after EPF deductions. Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or.

Change In Accounting Period. Dialog Minutes For Operational. First at the top of the page to ensure that you have not already not registered previously.

Amending the Income Tax Return Form. Offences Fines and Penalties. Change In Accounting Period.

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

How To File Income Tax For The First Time

𝗧𝗮𝘅 𝗳𝗶𝗹𝗶𝗻𝗴 𝗗𝗲𝗮𝗱𝗹𝗶𝗻𝗲𝘀 𝗳𝗼𝗿 𝟮𝟬𝟮𝟭 Ks Chia Associates Facebook

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

How To Amend An Incorrect Tax Return You Already Filed 2022

Company Malaysian Taxation 101

Amended Return Form Malaysia Fill Online Printable Fillable Blank Pdffiller

Do You Need To File A Tax Return In 2018

Guide To Using Lhdn E Filing To File Your Income Tax

How To Step By Step Income Tax E Filing Guide Imoney

Form Cp 58 Duty To Furnish Particulars Of Payment Made To An Agent Dealer Or Distributor Etc Malaysian Taxation 101

Individual Income Tax In Malaysia For Expatriates

Electronic Filing Of Personal Income Tax Returns In Malaysia Determinants And Compliance Costs Semantic Scholar

How To Step By Step Income Tax E Filing Guide Imoney

Just An Ordinary Girl How To Do E Filing For Income Tax Return In Malaysia

Business Income Tax Malaysia Deadlines For 2021

Personal Income Tax E Filing For First Timers In Malaysia

Why It Matters In Paying Taxes Doing Business World Bank Group

Electronic Filing Of Personal Income Tax Returns In Malaysia Determinants And Compliance Costs Semantic Scholar

Comments

Post a Comment